What a strange loop, this book. No one covers eccentric personalities like Jon Ronson. I first heard the author reading some of his work on This American Life, way back when it was only a radio show before it was a podcast. His voice takes some getting used to, but it matches his subject matter …

Category Archives: Personal

When Yoda comes to church

Over a decade ago, I took a job that relocated me from Texas to Colorado. That move was the best decision I ever made.

Before The Fall review

[stextbox id=’info’]Ad: ACCE International[/stextbox] You can immediately feel Hawley’s fingerprint all over this story. The prose is so well crafted and pops with an energy.

Audio book roundup, volume 2

Ok, it’s that time again: time for another round of recent audio book reviews, as seen over on my GoodReads.

Audio book roundup

I’ve been “reading” a lot of books lately, thanks to the magic of audio books on my phone. I use the word reading loosely here, since it feels like a lot less work for a slow reader like me. Yet, I can’t argue with the science that confirms that, while listening to the spoken word, …

Liturgy and Eucharist

For the past several years, I’ve found myself undergoing what can only be described as a thorough reckoning. “Do I really believe all this stuff?” is a question I would subconsciously ask myself as often as I ate food.

Avengers: Endgame

“Avengers: Endgame” marks the end of a generation of aging nerds like myself. It stirred up in me so much emotion that I wasn’t prepared for and I can’t wait to see the 3 hour finale again.

#BecauseOfRHE, Abe and Jonas

One of my most precious parenting rituals is reading to my children before their bedtimes. My son is in love with the Magic Tree House series, having read (listened) to probably 90% of the collection twice over by now.

Gym Philosophy: return to normal

“I dunno, I think this is all ok. We got the first black president out of the way. We got the first woman out of the way. Now we got a billionaire president out of the way. Maybe soon we can get back to normal again.” – some dude at my gym one morning

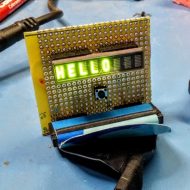

Featured on The Engineers’ Tribune

The engineering community and news outlet website reached out to me to feature my blog. I appreciate the opportunity! [stextbox id=’info’]ElectroLund highlight on Engineers’ Tribune[/stextbox] Sponsored by: Amphenol Connectors PEI-Genesis